Join a company that helps you differentiate yourself

marketing

Title

Phone

Bio

It all starts with the right infrastructure

Access to Top Producing Realtors

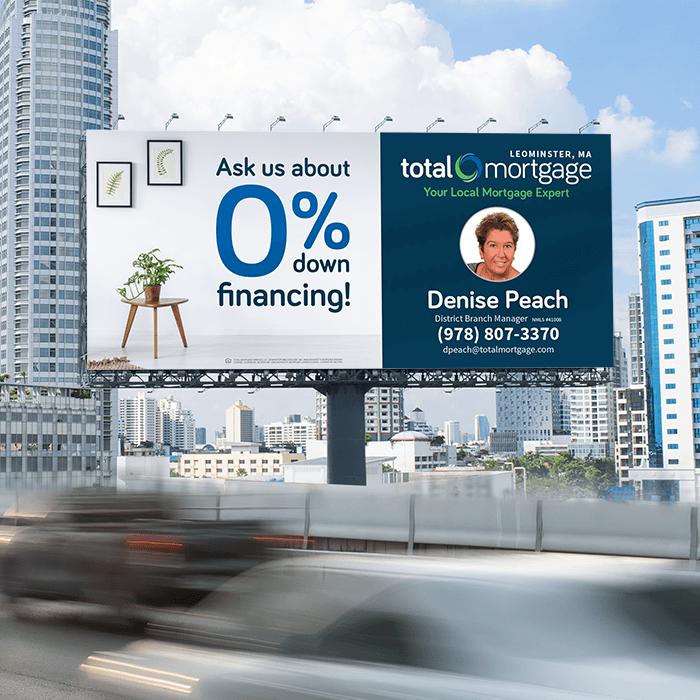

Personal Dedicated Marketing Team

Event Support and Videography

State of the Art Tools and Resources

The Total Mortgage Story

How We've Helped Borrowers - and Loan Officers - Mortgage Easier Since 1997

Total Mortgage was founded in Connecticut in 1997 by John Walsh, a loan officer with years of experience helping borrowers reach their goals. Since then, a lot has changed and the company found its strength in being able to evolve and grow. We’ve pivoted with the times and have been a borrower-first business, always – and that focus has remained consistent for over 27 years.

After the housing market crash, we took advantage of the early 2010s and used that time to evaluate our best path forward. Scott Penner took over as CEO and we began a growth trajectory that truly revolutionized our business. Rather than pursuing new business leads, we placed a higher emphasis on referrals, our realtor partners, and actively recruiting new branch locations.

Since 2017, this strategy has worked tremendously well. We now have over 30 branch locations staffed with loan officers who have seen amazing growth in their production – some even doubling their numbers from previous companies.

It all works because of this simple philosophy: we want our loan officers to build their business, build their brand, and realize their full potential. To do this, we support them like no other company can. Our full-service marketing resources, back-office operations teams, and flexible work culture create the perfect recipe for success.

Here are some extra facts about us – our results, statistics, and more:

- We have closed $1B of business annually since 2019.

- We’ve been named Connecticut’s #1 Purchase Lender for four consecutive years.

- The majority of our business is purchase-based (even during the earliest months of the pandemic).

- We’re licensed in 44 states (plus DC and Guam) and have over 400 employees.

- We’re a direct seller servicer (FNMA, Freddie, and Ginnie).

- We focus heavily on technology and have developed in-house software to streamline the process – for our loan officers, our borrowers, realtors, and more.

- We have an in-house marketing/tech team that includes developers, graphic designers, videographers, copywriters, and more – all of which support our sales teams and their business.

Design that matches your identity

“This is my seventh company that I’ve been with, and I can tell you right now, sitting here today, that this is the company I will end my career with.”

Jorge DosSantos

BRANCH MANAGER | BROCKTON, MA

Don't just take our word for it

Hear it from the people who witness it every day.

Let's Connect